Anyone who has made an insurance claim knows it can be a long and frustrating process. A new blockchain framework created by researchers from Nanyang Technological University and the Indian Statistical Institute could make insurance claims and payments more secure and efficient for companies and consumers.

Blockchain was originally created to securely transmit data for the cryptocurrency Bitcoin, but different fintech applications are beginning to incorporate the technology. Blockchain is a data structure where data blocks are created and stored in a chain organized by date. These data blocks are time-stamped and immutable, which creates a secure and public digital ledger. This permanence and organization helps streamline transactions by allowing all involved parties to easily find and verify transaction data.

The blockchain structure and design fits well in an industry like insurance, as the industry depends on multiple processes between different parties for starting, maintaining and executing insurance policies. Additionally, the money involved in insurance claims makes all parties involved concerned with security and transaction time.

“Making an insurance claim can be tedious and a lot of unnecessary information is given to the insurance company that could be used to violate someone’s privacy,” said Sushmita Ruj, researcher at the Indian Statistical Institute. “By using our blockchain framework with cryptographic techniques to control user access and anonymous credential management, it is easier to expedite and secure the claim process to comply with privacy regulations enforced by many countries.”

The researchers built their blockchain framework using Hyperledger Fabric, an open source blockchain platform. The framework’s design allows it to be used for both completing insurance contracts and storing the results. It also employs cryptographic algorithms to control user access and authenticate users on the network.

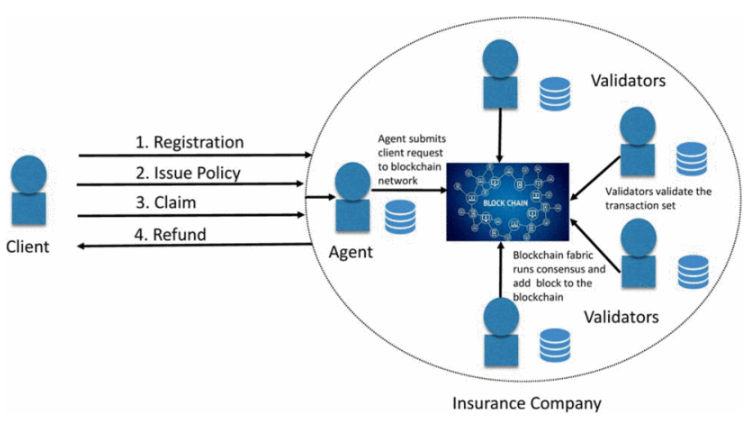

The researchers’ framework uses an agent and client model with smart contracts. The client applies for an insurance policy and makes claims, while the agent processes any client requests using the blockchain framework. Smart contracts are the computer protocols used to regulate and enforce terms of an agreement in the system.

Insurance processes such as claims, policies or registrations are encoded as smart contracts, and each type of process has a designated set of endorsers. All conditions for the endorsers must be accepted by the framework’s validator functions before the insurance process can be finalized. Throughout, both the client and agent are able to see the permanent records of a request on the framework.

Figure 1: System model of the insurance blockchain framework

System tests demonstrated the framework could securely complete up to 30 insurance processes with transaction times under 30 seconds. The experiments revealed transaction time increased depending on the number of endorsers for a smart contract and the number of transactions being processed in the system.

With these results in mind, the researchers are working to improve the scalability and reduce transaction time in the blockchain framework. The researchers also want to fine tune the cryptographic techniques embedded in the framework to further improve the system’s security and privacy features.

While the researchers’ blockchain framework needs further development, blockchain technology is set to play a major role in the future of the insurance industry. A major insurer funded this study, and other companies are exploring similar blockchain applications. Someday soon, a blockchain framework could make insurance claims a more transparent and pleasant experience.

For more information on blockchain frameworks, visit the IEEE Xplore Digital Library.